The market for agricultural biologicals, which was created in response to the rising demand for environmentally friendly and sustainable agricultural methods, has grown to be an essential part of the global agricultural sector. In order to increase crop output while reducing its negative effects on the environment, agricultural biologicals refer to a wide range of goods made from natural sources, such as microbes, plants, and helpful insects. Traditional chemical inputs like insecticides and synthetic fertilizers are replaced or supplemented by these biological remedies. They are essential for enhancing soil health, raising crop yields, and lowering dependency on synthetic pesticides, all of which improve the sustainability of farming as a whole. Biopesticides, biofertilizers, and biostimulants are significant subsectors of the market for agricultural biologicals. Biopesticides work to eliminate pests and diseases while remaining non-toxic to people and helpful critters. The availability of nutrients is increased by biofertilizers, and plant growth and stress resistance are increased by biostimulants. Due to growing awareness of the harms conventional farming practices provide to the environment and human health, the market has experienced tremendous expansion. Agriculture biologicals are being adopted by governments, consumers, and agricultural producers more frequently to provide food security and environmental preservation. The agricultural biologicals market is anticipated to be crucial in encouraging ecologically friendly and sustainable farming methods as global agriculture continues to change.

AGRICULTURAL BIOLOGICALS MARKET: REPORT SCOPE & SEGMENTATION

| Report Attribute | Details |

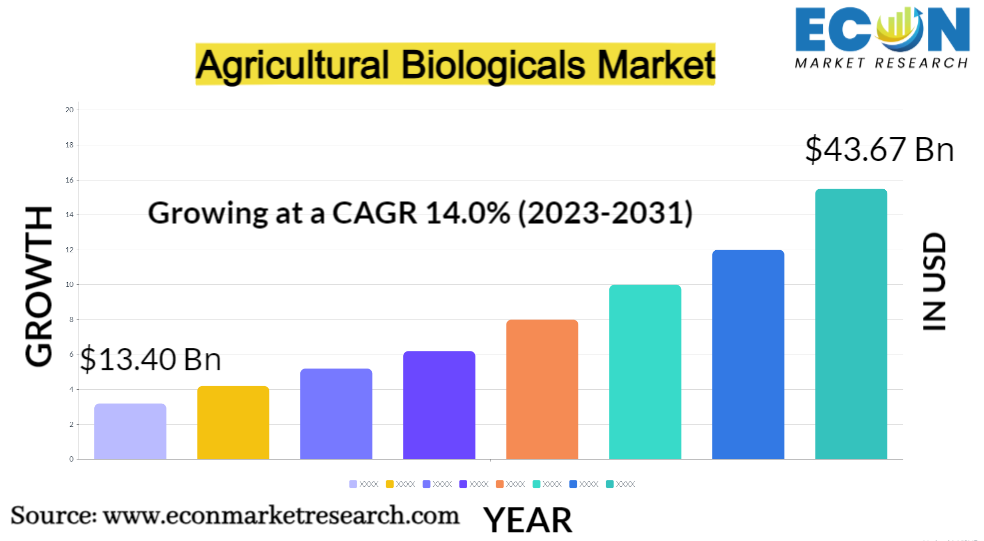

| Estimated Market Value (2022) | 13.40 Bn |

| Projected Market Value (2031) | 43.67 Bn |

| Base Year | 2022 |

| Forecast Years | 2023 - 2031 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Function Type, By Product Type, By Application, By Crop Type, & Region |

| Segments Covered | By Function Type, By Product Type, By Application, By Crop Type, & Region |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2031 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and the Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Global Agricultural Biologicals Market Dynamics

The market for agricultural biologicals has seen significant changes recently. The need for biological inputs has increased as a result of growing environmental concerns and a focus on sustainable farming methods. With the move towards organic and environmentally friendly agriculture, biopesticides, biofertilizers, and biostimulants have become more popular as alternatives to their chemical equivalents. Government policies encouraging the use of less chemical pesticides and the advancement of bio-based remedies have also been crucial. Biologicals are also being accepted for their role in enhancing soil health and plant resilience as farmers attempt to improve crop yields and quality. Continuous research and innovation, which result in the introduction of novel microbial strains and biotechnology developments, further emphasize the market's dynamic. Agribusinesses, biotechnology companies, and startups working together to develop new products and expand their markets are fostering growth. Due to its alignment with both consumer desire for safer, more ecologically friendly food production techniques and the global sustainability goals, the agricultural biologicals market is positioned for long-term growth.

Global Agricultural Biologicals Market Drivers

- Growing Demand for Sustainable Agriculture

A key factor driving the market for agricultural biologicals is the rising desire for sustainable agriculture. First and foremost, because of a better understanding of the negative effects of conventional agriculture on the environment, environmental awareness is growing. More sustainable options are being urged due to issues including soil erosion, water contamination, habitat damage, and biodiversity loss. Consumers, decision-makers, and farmers are all more dedicated to preserving the planet's long-term health as a result of this increased understanding. Additionally, sustainable agriculture seeks to lessen the reliance of the sector on chemical inputs, such as artificial fertilizers and pesticides, which may have a negative impact on ecosystems and human health. Sustainable farming methods, such as the use of agricultural biologicals, offer non-toxic, environmentally acceptable answers to these issues.Another crucial factor driving sustainable agriculture is resource conservation, which aims to protect natural resources like water and arable land for future generations. The adoption of practices that improve resource efficiency, such as precision agriculture and organic agricultural techniques, is being sparked by this dedication to resource conservation.

- Reduction in Chemical Residues

A crucial and compelling aspect affecting the agricultural biologicals market is the driver of a decrease in chemical residues in agriculture. This pattern indicates an increase in public knowledge of the harmful effects that chemical residues have on the environment and human health. Food products may contain chemical residues from the pesticides and synthetic chemicals used in traditional farming. Consumers are becoming more and more concerned about the potential health concerns linked to ingesting these residues, which range from acute poisoning to a variety of chronic ailments. Chemical residues can harm non-target creatures by degrading soil, polluting water sources, and contaminating ecosystems. For these negative environmental consequences to be minimized, chemical residues must be reduced. Greater controls and maximum residue limits (MRLs) for chemical residues on food products are being implemented by governments and regulatory organizations around the world. To meet these demands, this is causing farmers and agribusinesses to look into alternatives like agricultural biologicals. Food that is organic and sustainably produced, which is frequently assured to have less chemical residues, is becoming more and more popular with customers. Producers are being driven to reduce chemical inputs and embrace sustainable practices by this consumer demand.

Restraints:

- Limited Efficacy and Consistency

The market for agricultural biologicals is significantly constrained by these products' low consistency and performance. Agricultural biologicals provide a more environmentally benign alternative to synthetic chemicals, although their efficacy is frequently inconsistent. First, environmental factors like temperature, humidity, and the presence of friendly or hostile creatures affect how effective agricultural biologicals are. Because biologicals are living things or natural substances, as opposed to synthetic chemicals, whose reactions are frequently more predictable, their performance is influenced by these outside variables. Consequently, agricultural biologicals may not always be as effective at preventing pest or disease outbreaks as their chemical counterparts, raising questions about their dependability. The target pest or illness as well as the particular biological agent utilised might have an impact on efficacy. While some biologicals have a narrower range of activity, others are highly specialized and powerful against particular pests. Farmers may find it difficult to select the best biological product for their unique situation due to this variety.

- High Research and Development Costs

High research and development (R&D) expenditures are a key barrier for the market for agricultural biologicals. Smaller businesses and organizations may be discouraged from entering the market because to the high cost of developing, testing, and bringing agricultural biological products to market. First, substantial scientific investigation and testing are required for the creation of agricultural biologicals. This entails identifying and characterizing advantageous microorganisms, creating potent medicines, running field tests, and negotiating challenging regulatory approval processes. This makes it a capital-intensive endeavour because these operations demand significant financial resources and expertise. Additionally, navigating the regulatory environment for agricultural biologicals can be difficult and expensive. Companies must invest in extensive studies to demonstrate product safety and efficacy, and they must adhere to stringent registration and approval procedures imposed by government agencies. These expenses can pose a significant barrier to market entry.

Opportunities:

- Rising Global Population and Food Security

There is a rising need for food production as the world's population continues to rise. In order to improve food security, this presents an opportunity for agricultural innovation, environmentally friendly farming methods, and technological solutions. The agricultural industry can engage in cutting-edge practices like precision agriculture, smart farming, and the use of agro biologicals to increase crop yields while preserving resources to take advantage of this potential. Research on high-yielding, drought-resistant crop types can also help to ensure that there is food available even in difficult environmental conditions. Additionally, improvements in food storage, transport, and supply chain management can help reduce food waste and guarantee that the expanding world population has access to a sufficient and nourishing food supply. This opportunity also extends to international collaboration in sharing best practices and resources to optimize global food production and distribution.

- Advancements in Biotechnology and Research

Research and technological developments in biotechnology offer a unique chance to revolutionize a number of industries, including healthcare, agriculture, and the environment. New developments in biotechnology, such CRISPR-Cas9 gene editing and synthetic biology, have the ability to solve complicated problems and have a significant positive influence. Personalized medicine, which allows for customized treatment plans based on a person's genetic makeup, is made possible in the field of healthcare by biotechnology. This strategy may result in medicines that are more effective and have fewer side effects, which would eventually improve patient outcomes and lower healthcare costs. In agriculture, biotechnology can advance sustainable practices by raising crop yield, improving crop resilience, and minimizing the need for hazardous chemical inputs. In addition to ensuring food security for a growing global population, this also lessens the negative environmental effects of conventional farming.The creation of renewable energy sources, biodegradable materials, and more environmentally friendly industrial techniques are all made possible by advances in biotechnology. These developments have the potential to considerably improve environmental sustainability and a smaller carbon footprint.

Segment Overview

By Function Type

Based on function type, the global agricultural biologicals market is divided into biopesticides, biofertilizers, biostimulants. The biopesticides category dominates the market with the largest revenue share in 2022. Biopesticides are natural alternatives to chemical pesticides, derived from living organisms like bacteria, fungi, or plants. They offer effective pest control while minimizing harm to non-target species and the environment. The rising demand for organic and pesticide-free produce has fueled the growth of biopesticides, making them a critical component in integrated pest management systems. Biofertilizers, on the other hand, focus on improving soil health and enhancing nutrient absorption by plants. These products contain beneficial microorganisms, such as nitrogen-fixing bacteria and mycorrhizal fungi, which help increase nutrient availability to crops. Biofertilizers are essential in sustainable agriculture, reducing the reliance on synthetic fertilizers and mitigating their environmental impact. Biostimulants are a category of agricultural biologicals designed to enhance plant growth and development by stimulating natural processes. They may contain plant hormones, beneficial microbes, or various organic compounds that improve stress tolerance, root development, and overall plant vigor. Biostimulants contribute to increased crop yields and improved crop quality, particularly in challenging growing conditions.

By Product Type

Based on the product type, the global agricultural biologicals market is categorized into microbials, macrobials, natural products. The microbials category leads the global agricultural biologicals market with the largest revenue share in 2022. Microbials refer to microscopic organisms used in agriculture to enhance soil health, control pests, and promote plant growth. This category includes beneficial bacteria, fungi, and other microorganisms. For example, nitrogen-fixing bacteria can help convert atmospheric nitrogen into a form usable by plants, improving nutrient availability. In pest management, certain beneficial microbes can act as biopesticides by antagonizing harmful pathogens. Microbials play a vital role in fostering sustainable farming practices by reducing the reliance on chemical inputs. Macrobials encompass larger organisms that contribute to agriculture. This category includes beneficial insects, nematodes, and larger organisms that help control pests and maintain ecological balance in agricultural ecosystems. For instance, ladybugs are often introduced to combat aphids, while parasitic nematodes can help control harmful soil-dwelling pests. Natural products in agriculture are derived from plant or animal extracts and other naturally occurring substances. These products include botanical extracts, essential oils, and other organic compounds. They are used for various purposes, such as pest repellent or growth enhancers.

By Application

Based on application, the global agricultural biologicals market is segmented into foliar spray, seed treatment, soil treatment. The seed treatment segment dominates the agricultural biologicals market. Seed treatment involves coating seeds with various agricultural inputs, including fungicides, insecticides, and inoculants, before planting. This method aims to protect seeds from soilborne diseases and pests while promoting healthier seedlings. It also enhances the early growth and establishment of crops. Seed treatments are a preventive approach that can reduce the need for subsequent pesticide applications and optimize germination and seedling vigor. Foliar spray involves the application of agricultural inputs, such as pesticides, fertilizers, and biostimulants, directly to the leaves of plants. This method allows for the rapid absorption of nutrients and active ingredients through the plant's foliage. Foliar sprays are especially useful for addressing nutrient deficiencies, controlling foliar pests and diseases, and providing essential elements for plant growth. Soil treatment focuses on improving the quality and health of the soil in which crops are grown. This method includes the incorporation of biofertilizers, soil conditioners, and beneficial microorganisms into the soil. Soil treatments enhance nutrient availability, soil structure, and microbial activity, resulting in healthier and more productive plants. Soil treatments are typically applied prior to planting or as part of ongoing soil management practices to ensure long-term soil health and sustainable crop production.

By Crop Type

Based on crop type, the global agricultural biologicals market is divided into grains and cereals, pulses and oilseeds, and fruits and vegetables. The grains and cereals category dominates the market with the largest revenue share in 2022. This category encompasses crops like wheat, rice, maize (corn), barley, oats, and others. Grains and cereals are staple crops that provide a significant portion of the world's caloric intake. They are used for various food products, including bread, pasta, and cereals, and are also important for animal feed and, in some cases, industrial uses like biofuels. Pulses include crops like lentils, chickpeas, and beans, which are rich in protein and essential nutrients. Oilseeds include crops such as soybeans, sunflowers, and canola, which are primarily grown for their oil content. Pulses and oilseeds are crucial for global food security, as they provide protein for both human and animal consumption and are a source of vegetable oils used in cooking and food processing. Fruits and vegetables category covers a wide variety of crops, including apples, bananas, tomatoes, carrots, and many others. Fruits and vegetables are essential components of a balanced diet, providing vitamins, minerals, and dietary fiber. They are consumed fresh, processed into various products like juices and canned goods, and serve as an important source of nutrition and flavor in cuisines worldwide.

Global Agricultural Biologicals Market Overview by Region

The global agricultural biologicals market is categorized into North America, Europe, Asia-Pacific, and the Rest of the World. North America emerged as the leading region, capturing the largest market share in 2022. Particularly in the areas of technology, innovation, and economic growth, North America has established itself as the premier region in a number of areas. This region, which consists of the US and Canada, has a vibrant and diverse economy that has been essential in reshaping the world. At the heart of North America's leadership are innovation and technology. For instance, the Californian region of Silicon Valley is the world's epicentre of technology development and is home to many of the top tech firms. Cutting-edge technology and software as well as game-changing biotechnological developments are regularly produced by this area. These inventions promote economic expansion and have a wide-ranging effect on global industry. In addition, North America's dedication to research and education has resulted in the creation of top-tier universities, research facilities, and labs, encouraging a culture of ongoing learning and discovery. The region's commitment to R&D has led to innovations in industries like healthcare, biotechnology, renewable energy, and aerospace. The free-market values and entrepreneurial spirit of North America have drawn enterprises and investments from all over the world. Due to this economic attraction, massive corporations, financial hubs, and enormous trade networks have emerged. Strong consumer demand and linked supply networks in North America further support the region's status as the world's economic leader.

Global Agricultural Biologicals Market Competitive Landscape

In the global agricultural biologicals market, a few major players exert significant market dominance and have established a strong regional presence. These leading companies remain committed to continuous research and development endeavors and actively engage in strategic growth initiatives, including product development, launches, joint ventures, and partnerships. By pursuing these strategies, these companies aim to strengthen their market position, expand their customer base, and capture a substantial share of the market.

Some of the prominent players in the global agricultural biologicals market include Bayer AG, Koppert B.V., Marrone Bio Innovations, FMC Corporation, Gowan Company LLC, Vegalab SA, The Stockton Grou, International Panaacea Limited, InVivo Group, Biolchim Group, Seipasa S.A., Syngenta AG, BASF SE, Novozymes A/S, Andermatt Biocontrol AG, Certis U.S.A. LLC, and various other key players.

Global Agricultural Biologicals Market Recent Developments

In September 2023, Crop biologicals company Biobest plans to expand into South America by purchasing Biotrop in Brazil for $570 million. In a deal worth $569.4 million, Belgium's Biobest, which creates biologically based crop protection and pollination solutions, will buy Brazil's Biotrop. Through the agreement, Biobest will acquire an 85% share in Biotrop; the remaining 15% will be acquired by the company following a three-year transition period.

In May 2023, starting the agricultural biologicals era. In recent years, agricultural technology has advanced dramatically. Farms all throughout the world now have combines, ploughs, and satellite imagery thanks to the technology wave.

Scope of the Global Agricultural Biologicals Market Report

Agricultural Biologicals Market Report Segmentation

| ATTRIBUTE | DETAILS |

| By Function Type |

|

| By Product Type |

|

| By Application |

|

| By Crop Type |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

Objectives of the Study

The objectives of the study are summarized in 5 stages. They are as mentioned below:

- Global Agricultural Biologicals Market Size and Forecast:

To identify and estimate the market size for the global agricultural biologicals market segmented by function type, by application, by product type, by crop type, region and by value (in U.S. dollars). Also, to understand the consumption/ demand created by consumers of agricultural biologicals between 2019 and 2031.

- Market Landscape and Trends:

To identify and infer the drivers, restraints, opportunities, and challenges for the global agricultural biologicals market

- Market Influencing Factors:

To find out the factors which are affecting the sales of agricultural biologicals among consumers

- Impact of COVID-19:

To identify and understand the various factors involved in the global agricultural biologicals market affected by the pandemic

- Company Profiling:

To provide a detailed insight into the major companies operating in the market. The profiling will include the financial health of the company's past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Intended Audience

- Medical Professionals

- Researchers and Academics

- Retailers, Wholesalers, and Distributors

- Governments, Associations, and Industrial Bodies

- Investors and Trade Experts