The Material handling equipment market includes a variety of tools, vehicles, warehouses, equipment, and accessories involved in the transport, storage, control, calculation, and counting of products at any stage of manufacturing, distribution, use, or disposal. The main objectives of asset management are as follows: It must be able to determine the appropriate distance to be installed. Prepare for waste reduction to improve quality. Reduce the overall performance time by designing the movement of the material.

Growth Factors

The flow of investments for the development of power and battery technology will contribute to market growth. Apart from that, favourable government initiatives worldwide encourage new infrastructure development, resulting in growth prospects in the material handling equipment market over the forecast period (2023–2031). The developing economies, such as India and China, attract foreign investments promoting infrastructure and industrial development; this is expected to drive market growth. Also, the development of public infrastructure, such as rail networks, airports, seaports, and power plants, among others, is estimated to foster market growth.

The development of the Belt and Road Initiative (BRI) by China is anticipated to create lucrative opportunities that will fuel the growth of the materials handling equipment market. This initiative focuses on connecting a network of rail and road routes from China to Europe via the Middle East. The Material Handling Equipment Market has greatly benefited from the rapid rise of the e-commerce industry. Furthermore, in reaction to the COVID-19 epidemic, the imposition of social distance rules, lockdowns, and other measures has prompted consumers to turn to online shopping, which has helped market growth.

The increase in labor costs and safety concerns has led many industries to choose equipment in order to improve work efficiency and time reduction, and this factor will foster market growth. Also, with the enhancement of technology, there will be a demand for automation and productivity, which will trigger market growth. Furthermore, the increasing requirement for efficient material movement necessitates automated processes, which are expected to fuel market growth.

Material Handling Equipment Market REPORT SCOPE & SEGMENTATION

| Report Attribute | Details |

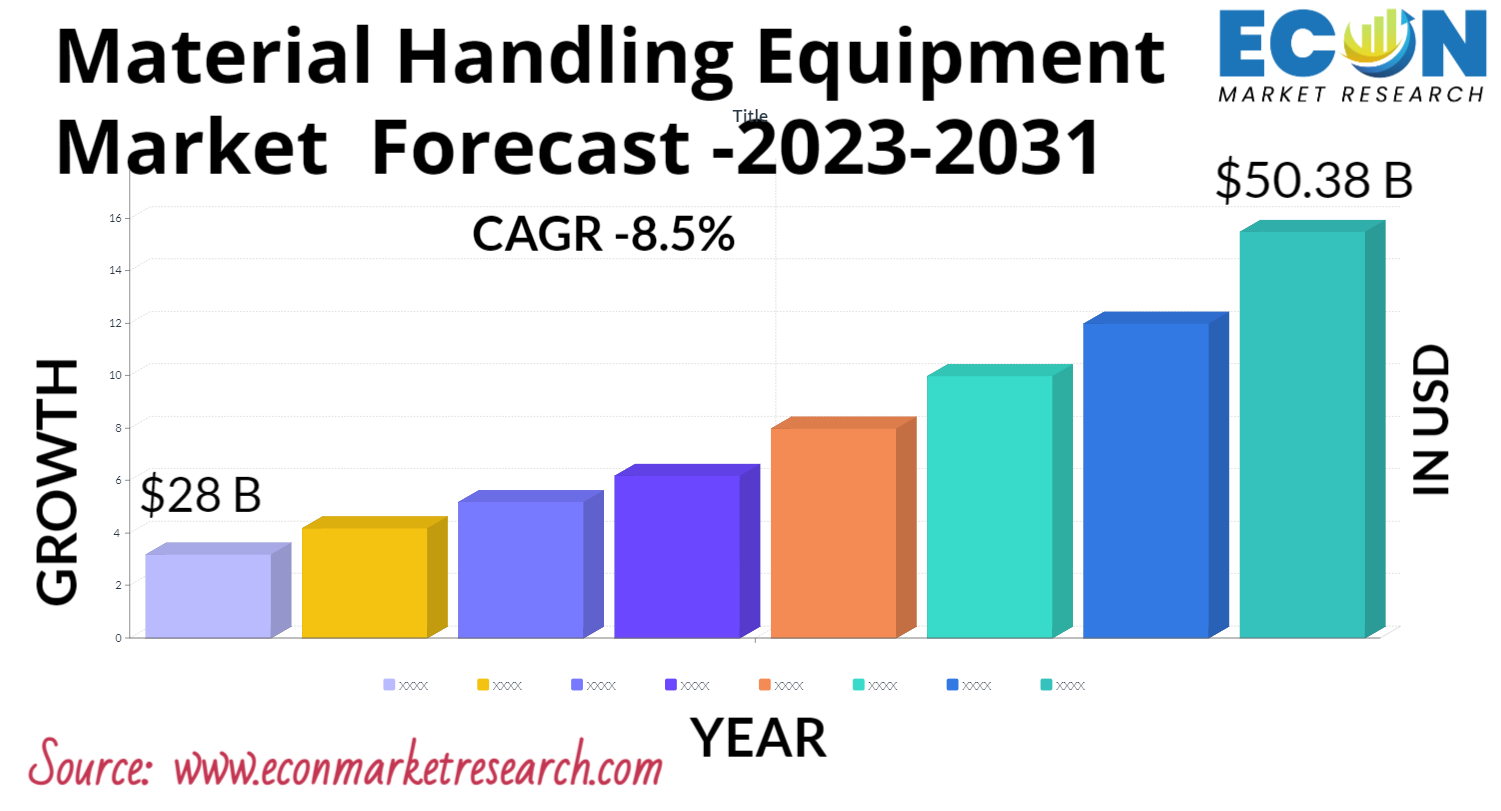

| Projected Market Value (2031) | 50.38 Billion |

| Estimated Market Value (2022) | 28 Billion |

| Base Year | 2022 |

| Forecast Years | 2023 - 2031 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Product Type, By End-user, & Region |

| Segments Covered | By Product Type, By End-user, & Region |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2031 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Market dynamics:

Market drivers:

The rapid growth of the e-commerce sector across the globe, where consumers are intensively purchasing regular goods, is promoting the overall growth of the material handling equipment industry. For instance, USD 4.46 trillion was spent on online shopping in the year 2022 across the globe. The trend of online shopping continues to increase, which is considered the major market driver of the material handling equipment industry.

The customization of equipment and systems that are integrated with warehouse and supply chain ecosystems is increasing visibility for manufacturers and industrial sectors. In addition, rising labour costs in developed countries are propelling the material handling equipment market forward.

Market opportunities:

The increasing investment in the material handling equipment industry by the established market key players is bringing about a series of inventions and updates in the material handling equipment industry. Such factors are stimulating the potential end-users to increase their utilization of material handling equipment for their business growth.

Some of the government initiatives are presenting lucrative opportunities for the growth of the material handling equipment industry. Especially, the "One Belt, One Road" (OBOR) initiative by the Chinese government has stimulated the development of the material handling equipment industry.

Market restraints:

The increasing investments in the initial stages and the overall costs of ownership are expected to hinder the material handling market's growth. The procurement, integration, programming, and installation of this material handling equipment are particularly expensive. Moreover, the higher maintenance costs and the slower return on investments are some of the restraining factors for material handling equipment market growth.

Some of the major restraining factors in the material handling equipment industry are the costs of replacing software and customizing software to meet the needs of the company.

Market challenges:

The life cycle costs of the material handling equipment, such as capital investment, installation, setup, programming, training, system testing, operation, maintenance, repair, and reuse, are the major costs that are hindering the overall growth of the material handling equipment market.

The major challenge for the growth of the material handling equipment market is a lack of awareness about the availability of operating equipment and the various operations that these machines can perform.

Geographical Analysis

Europe is expected to dominate the market with a revenue share of more than 37.5% in 2022 and is expected to grow significantly over the forecast period. It's due to the employment of innovative products to support the region's large-scale industrialization. Europe has a diverse range of industries, from food and beverage to electronics manufacturing, all of which offer sales opportunities. Furthermore, the e-commerce sector, led by same-day delivery models, has contributed significantly to market growth. For instance, on October 14, 2021, Logstica Carosan, a Spanish storage and transportation company, stated that it has rebuilt its Talavera de la Reina (Spain) facility in order to improve customer service. The company will adopt Mecalux's Easy WMS warehouse management system to streamline all of its logistical procedures. The technology will allow LogsticaCarosan to keep a close eye on its clients’ entire inventory.

North America is also expected to have substantial growth in the material handling equipment market, which is due to the increasing sales across the region due to the e-commerce industry. The increasing growth of durable and non-durable goods is propelling the overall growth of the material handling equipment industry's. Moreover, North America is adopting automated warehouse practises across the region, fueling the overall growth of the material handling equipment sector.

The Asia Pacific region is also expected to grow significantly over the forecast period, with a CAGR of 9.8% in 2022. It is because the developing economies have provided ample opportunities, subsequently helping OEMs reach broader end user markets. Moreover, the rapid growth of the e-commerce industry in this region is anticipated to boost market growth.

Key Companies Profiled

Manufacturers are focusing on adopting various marketing strategies, such as collaboration and mergers and acquisitions with other logistics solution businesses, to attain a considerable position in terms of comprehensive strength. Key players are consistently providing a variety of specialized machines, such as cranes, industrial trucks, and others, and material handling technologies to their end-users across countries in order to deeply penetrate the market.

- Liebherr Group

- KION Group AG

- Jungheinrich AG

- Viastore Systems GmbH

- WITRON Logistik + Informatik GmbH

- Eisenmann AG

- Beumer Maschinenfabrik GmbH

- Jervis B. Webb Company

- Columbus McKinnon Corporation

- Crown Equipment Corporation

- Hyster-Yale Materials Handling

- Hytrol Conveyor Co., Inc.

- Manitowoc Company, Inc.

- Xuzhou Heavy Machinery Co., Ltd.

- Toyota Industries Corporation

Recent Developments

- In April 2022, KION Battery Systems GmbH (KBS) will expand its Karlstein production plant, marking the next step in the company's expansion and innovation. The company, a partnership between KION GROUP AG and BMZ Holding GmbH, has now officially launched a second production line for producing 24-volt batteries used in mobile warehouse handling equipment.

- In March 2021, Aarekies Brienz AG, situated in Brienz, Switzerland, purchased an industrial truck from Liebherr Group dubbed the "LH 60 M Port Litronic."

Segments covered:

By Product

- Storage & Handling Equipment

- Automated Storage & Retrieval System

- Industrial Trucks

By End-user Sector

- Automotive

- Food & Beverages

- Chemical

- Semiconductor & Electronics

- E-commerce

- Aviation

- Pharmaceutical

- Others

By Region

- North America (US, Canada, Mexico)

- Europe (UK, Germany, France, Rest of Europe)

- Asia Pacific (China, India, Japan, Rest of APAC)

- LAMEA (Latin America, Middle East, Africa)

Customization Scope

- Available upon request

Pricing

- Available upon request